China Stainless Steel Market Update – Prices Weaken Amid Seasonal Demand Slowdown

China Stainless Steel Market Update

China’s stainless steel market came under pressure this week, with futures and spot prices moving lower amid weakening demand and cautious buying sentiment. Market activity cooled noticeably, and prices are expected to test lower support levels in the near term as fundamentals regain influence.

Futures Market Overview

China stainless steel futures declined throughout the week after an early rebound failed to hold. Selling pressure increased toward the end of the week, marking the end of the recent short-term uptrend. Trading volume remained high, while open interest dropped sharply—indicating fading speculative enthusiasm.

The main stainless steel futures contract closed at RMB 14,140/ton, down 3.97% week-on-week, reflecting growing caution across the market.

Related Products:

Stainless Steel Coils & Strips Stainless Steel Sheet Seamless Stainless Steel Pipe Stainless Steel Welded Pipe Stainless Steel Angle Stainless Steel Flat Bar Stainless Steel Round Bars

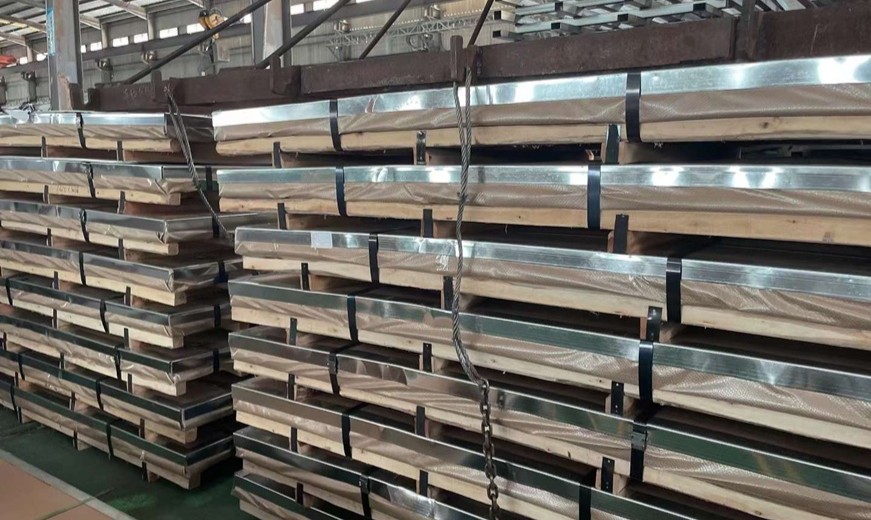

Spot Market & Physical Supply

Spot stainless steel prices in China fell by approximately RMB 150/ton this week. Market volatility increased as prices followed a sharp pullback in nickel.

With China entering a traditional off-season period, both supply and demand remain weak. Downstream buyers are purchasing mainly on a hand-to-mouth basis, while pre-holiday stockpiling remains limited. Trading activity in the spot market was subdued, and many traders focused on reducing inventories rather than building new positions.

Although raw material prices remain relatively firm, stainless steel mills are experiencing narrowing profit margins, which provides some cost support but has not been sufficient to stop price declines.

Inventory & Production Signals

Social inventories edged slightly higher as mill deliveries continued, while downstream consumption remained soft. Expectations of maintenance shutdowns in February have largely been priced into the market.

On the futures side, registered warehouse inventories increased to 43,519 tons, signaling renewed inventory accumulation amid weaker demand.

Key signal:

Rising inventories during the off-season suggest limited short-term upside for stainless steel prices.

Macro & Export Outlook

Despite recent monetary policy support, fiscal stimulus implementation has been slow, limiting its impact on real demand. Export conditions remain uncertain due to global macroeconomic factors, and buyer sentiment has cooled accordingly.

Market focus is now shifting back to fundamentals, including:

-

Mill production schedules

-

Raw material price movements (nickel & scrap)

-

Inventory trends ahead of the next demand cycle

Buying Insight for International Buyers

-

Short-term: Prices are likely to remain under pressure with a weak-to-stable trend.

-

Procurement strategy: Buyers with flexible delivery schedules may find better entry points by monitoring spot price adjustments.

-

Risk factor: Any sharp rebound in nickel prices could temporarily tighten offers.

For importers sourcing stainless steel coils and sheets from China, the current market favors cautious, phased purchasing rather than aggressive stock-building.